Knowing when the right time to replace your computers can be a tricky task, balancing getting the most out of your technology assets vs. ensuring your staff are able to work efficiently. Keeping your computers past their recommended age could be costing your business in staff hours.

In a study conducted by Microsoft, old computers are costing business owners more than $3,700AUD each. The additional cost of an old computer is not always obvious, it shows itself through extra IT support, or low staff productivity or even lost sales due to computer issues.

'Older computers are more than twice as likely to experience issues like being slow to boot up, batteries depleting too soon, disk drive crashes causing data losses, application crashes and network connectivity problems. The total cost of owning a PC that is four or more years old is enough to replace it with two or more newer models.' - Microsoft

It may not sound like a lot, but lets say your computer takes 10 minutes to restart, if you have an old computer often, you will need to restart it many times throughout the day. The restarting process takes 10 minutes, then you need to open your applications again which could take another 10 minutes, then getting back into the mindset of what you were doing before you had to restart. By the time that is all taken into account it could take 45minutes to an hour to get back on track. What if your team needs to do that multiple times a day? Productivity loss starts to add up pretty quickly.

There are many elements that come into play when deciding on the right time to replace your computer, here are a few questions you can ask yourself to get started:

- Is my computer still under warranty?

- Have I got the latest operating system?

- Is my computer making more noise than usual?

- Have I had my computer for 3 years or more?

Some computers can run for longer than 3 years, but it depends on what it is used for. If the computer is located in a warehouse, is used for design, excel work, or heavy administrative work, it may have a shorter lifespan.

From the 12th of March 2020 to the 31 December 2020, the ATO has increased the amount and expanded the eligibility for instant asset write offs. This is a great time to replace your computers, to make the most of your investment. We are not accountants, so you will need to speak to your accountant for specific tax advice.

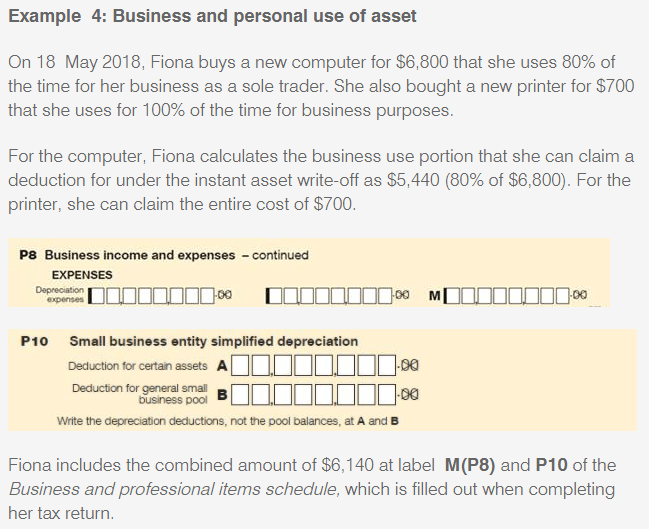

The ATO have a great example for a new computer and how much you could claim:

Ready to replace some of your technology assets? Get in touch with us to assess your technology fleet and talk about how you can use the 2020 tax write off to your benefit.

If you want to remove that stubborn blank page at the end of your report or delete a page containing […]

Read moreHow to Unsend an Email in Outlook “Have you ever experienced that sinking feeling in your stomach after accidentally sending […]

Read moreWe all spend a great deal of time in our internet browser, searching, googling, so it makes sense to not […]

Read more